By Kayla S. O’Connor, Esq.

Insurance Litigation Attorney at PALUMBO LAW

April 30, 2020—You might have heard the phrase “business interruption coverage” in the news lately, as small businesses all over the country have been ordered to close (or at least seriously cut back operations) due to the current COVID-19 Pandemic.

Many of these small businesses are now submitting claims under their Commercial Insurance Policies for the revenue they have lost, and continue to lose, each day their restaurants, bars, shops, and salons remain shuttered. Almost routinely, these claims are being denied.

This is a troublesome trend, as many insured businesses have dutifully paid additional premiums in exchange for what is commonly referred to as “Business Interruption” or “Business Income” coverage (i.e. added coverage designed to compensate the insured business for a loss of income incurred due to a slowdown or suspension of its operations at its premises, under certain circumstances), and because the different policy language that Insurers are citing in support of these denials is often ambiguous at best.

Our office is already receiving calls from Small Business Owners looking to sue their Commercial Property Insurers for wrongfully denying “business interruption” coverage under their respective Policies. Yet as a trial attorney who routinely sues Insurance Companies on behalf of home and small business owners whose claims are wrongfully denied or underpaid, I am not recommending that anyone sue anyone here—Or at least not yet, and not at all if it can be avoided.

Candidly speaking, neither Small Businesses nor their Insurance Companies can afford the delay, cost, or risk that widespread litigation of this magnitude and complexity would entail for both sides involved.

With the first $350,000 billion in Paycheck Protection Program loans running out before many could even apply for them, Small Businesses need this coverage NOW to get back up and running as the Covid-19 bans start to lift.

Meanwhile, their Insurers need some assurance that they will not go into bankruptcy defending (and potentially paying out large judgments on) such a high volume of individual lawsuits over this coverage issue.

Widespread litigation will not accomplish either of those goals, and could instead drag on for several years while the attorneys argue over the meaning of some particularly obscure clause in the policy. It could also overwhelm the courts and create a backlog of claims that would further delay things for all parties involved.

In an effort to curb such an influx of coverage-related litigation, New Jersey recently proposed innovative legislation that would effectively force insurers to presume coverage for COVID-19 closures. Although this is certainly a step in the right direction, it is not a viable answer to this mounting COVID-19 coverage problem, as Insurers simply cannot afford to pay so many policy limit claims all at once. Such legislation could also “face significant legal challenges, including challenges to its constitutionality based on the Contracts Clause — U.S. Const. art. 1, § 10,” which would lead to further delays in compensation for Insureds.

Fortunately, there is another option–an option first utilized in response to the September 11th, 2001 terrorist attacks, when Congress enacted the September 11th Victims Compensation Fund (“VCF”) to provide a much-needed, no-fault alternative to mass tort litigation under which attack victims (or their families) were afforded guaranteed, tax-free compensation for their injuries in exchange for their agreement to never file suit against the airline corporations involved for any lack of security or otherwise unsafe/negligent procedures.

From 2001 to 2003, the VCF processed claims relating to injuries and deaths caused by the 9/11 terrorist attacks under the direction of congressionally-appointed “Special Master,” Attorney Kenneth Feinberg, who developed a formula for calculating the awards to each victim (and each family of a victim) in a manner that aimed to ensure adequate compensation for all qualifying claimants without exceeding the VCF’s distribution limits or otherwise imposing additional financial strain on the airlines, their insurers, or the government. To strike this balance, Feinberg calculated each victim’s estimated lifetime earning capacity, and then set maximum limits on some of the highest earning victims’ recovery to ensure there were enough benefits to go around.

Though some families of the more highly-compensated financial professionals killed in the attacks did complain about the VCF’s limits on their awards, these concerns and complaints ultimately had to be balanced against the time, cost and risk of pursuing an individual case against the airlines; the potential trauma of re-living the events of 9/11 via litigation; and the real possibility that the airlines and their insurers could go bankrupt before being able to pay the claims. In the end, all parties gave a little, and the majority of families opted not to sue.

Like the 9/11 victims’ claims against the airlines, this current and unprecedented influx of disputed COVID-19 business interruption claims has the potential to delay needed compensation for Insured Businesses, and to completely overwhelm both our Insurance Companies and our Courts if both sides of the dispute do not come together in support of an alternative solution that avoids litigation.

I am therefore suggesting that we learn from Congress’s response to 9/11 by repurposing the so called “VCF model” to establish what I will hereinafter refer to as a “COVID-19 Insurance Relief Fund”.

Like the VCF, this proposed “COVID-19 Insurance Relief Fund” would provide a pre-budgeted, no-fault litigation alternative under which disputed COVID-19 “Business Interruption” claims could be streamlined and collectively processed via a pre-determined formula that affords guaranteed, immediate COVID coverage payments to qualifying Small Businesses in exchange for their agreeing not to sue their insurers for wrongful and/or bad faith denials of coverage.

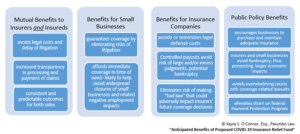

Such a COVID-19 Relief Fund is the best possible solution to the monumental problem, and would benefit Small Businesses, their Insurers, and the public at large in at least the following respects.

So how can we make this COVID-19 Insurance Relief Fund happen? Well, for starters, I am going to forward this article to my local politicians and congressional representatives in the hopes that it prompts them to enact some sort of executive order or legislation putting this proposed “COVID-19 Fund” into action.

But monumental change of this type requires widespread support and collaboration from both sides of the aisle. So please, consider this a call to action. If you agree with this idea, share this article with your friends and colleagues, and local legislators. Let’s start the conversation, and come together to promote and effectuate this much-needed alternative for the sake of our Small Businesses, their Insurance Companies, and our society at large.

Questions, comments, ideas? E-Mail me here. I would love to hear from you.

Need representation for YOUR denied claim? Call PALUMBO LAW today! We have offices in RI, MA, and CT, and are available to represent home and business owners in a variety of insurance coverage and property damage litigation.

- Law Offices of Richard Palumbo, LLC d/b/a PALUMBO LAW.

- For more details on business interruption coverage and the various conditions and policy exclusions that may apply to said coverage, see https://www.cpajournal.com/2020/04/29/will-business-interruption-insurance-provide-coverage-for-coronavirus-losses/

- Under the law of most states and general principles of contract formation, ambiguous policy provisions are construed in favor of the non-drafting party to the agreement—i.e. the Insured Small Businesses in this scenario.

- https://fortune.com/2020/04/16/ppp-loans-sba-paycheck-protection-program-money-funding-small-business-will-it-be-extended-congress/

- On March 16, 2020, New Jersey Bill A-3844 was introduced with the goal of assisting businesses impacted by COVID-19. The principle provision of draft Bill A-3844 states: “Notwithstanding the provisions of any other law, rule or regulation to the contrary, every policy of insurance insuring against loss or damage to property, which includes the loss of use and occupancy and business interruption in force in this State on the effective date of this act, shall be construed to include among the covered perils under that policy, coverage for business interruption due to global virus transmission or pandemic, as provided in the Public Health Emergency and State of Emergency declared by the Governor in Executive Order 103 of 2020 concerning the coronavirus disease 2019 pandemic.” this draft bill “is limited to insureds in New Jersey with fewer than 100 full-time employees, and the forced coverage [it would put in place] is still subject to policy limits. The draft bill also includes a provision allowing liable insurers to petition the commissioner of banking and insurance for partial reimbursement collected from other insurers in the state that did not issue business interruption coverage.” See, e.g., https://www.natlawreview.com/article/business-interruption-insurance-coverage-and-covid-19.

- https://www.natlawreview.com/article/business-interruption-insurance-coverage-and-covid-19

- Namely the Air Transportation Safety and System Stabilization Act (49 USC 40101).

- From 2001 to 2004, about $38 billion was paid out under the VCF by the government, charities and insurance companies. Insurance companies paid the most, covering 51%. See https://www.cnn.com/2013/07/27/us/september-11th-victim-aid-and-compensation-fast-facts/index.html (citing this comprehensive analysis by the Rand Institute)

- Specifically, families of some of the more highly-compensated victims argued that based on what their deceased relative was earning, the compensation offered under the VCF was lower than what they would have received had they filed suit and a court considered their case and damages on an individual basis.

- From 2001 to 2004, the VCF received and processed 2,963 a total wrongful death claims, which accounted for more than 98% of eligible families of victims killed in the attacks.