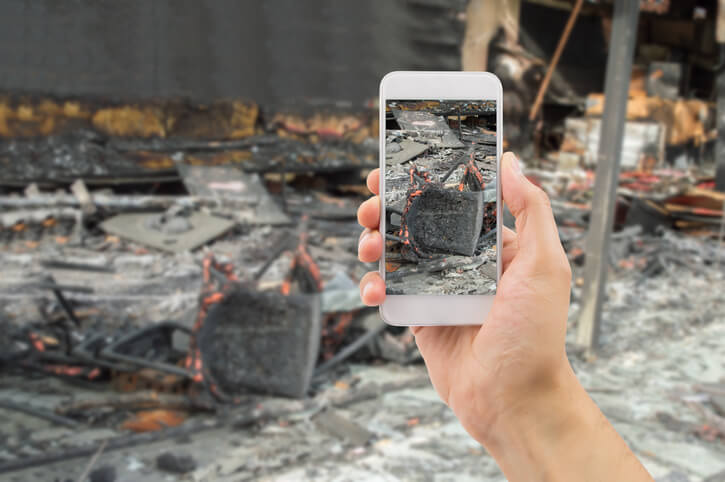

You may have heard the expression that a picture is worth a thousand words. But what you may not know is that a picture can also influence thousands of dollars. Pictures can often make or break a case as they often provide evidence that could not otherwise be equaled through mere words. When a policyholder is looking to recover from damage, pictures of the damage itself are invaluable. This holds true whether the claim is for flooding, fire loss, or any other types of claims.

What Should You Capture?

Luckily for you, most people nowadays have smartphones with cameras. Therefore, it is much easier to get your hands on a camera than it has ever been before. It’s good to take pictures of your property prior to anything bad happening. Therefore, when you experience a loss, you can take “after photos.” As a general rule, you may want to take pictures of your property – both inside and outside – on a quarterly basis. You may also wish to have a roofer or someone else qualified, take photos of the condition of your roof when they are on your property. This should include broad pictures of the roof as well as close-up pictures of it. Usually, about twenty to twenty-five pictures is a good amount when it comes to documenting different parts of your property. Other property that it is a good idea to capture images of includes:

- Garage doors

- Window screens

- Skylights

- Awnings

- Parapet walls

Capture pictures of interior water spots or stains on your walls and ceilings as well as any stains located near your hot water heaters or sprinklers. You will also want to keep an eye on your attic and take pictures of it – especially if your water heater is located there.

Using Your Photos to Combat Other Evidence

Since insurance companies often have their own sets of pictures, they can take them in such a way as to try to omit certain important factors, therefore hurting your claim. That’s why having your own set of images is so important. You will want to keep them in a saved folder on your cloud so that you will have them – even if your phone or laptop goes missing. Also, be sure to take photos after repair, so that if your property becomes damaged again, it can’t be claimed that the damage is merely a continuance of pre-existing damage. You will be able to show that the prior damage had been repaired.

Videos can also serve as good evidence in the event of a loss. Just be sure to include your property in the video to show that it is the location you are claiming and try to keep the clip to under thirty seconds. Also, make sure that your video is time-stamped.

PALUMBO LAW Helps Those in Rhode Island with their Fire Damage Claims

By working with an insurance attorney, he or she can help to walk you through each step of the process. Even if your claim has already been denied, a knowledgeable and qualified attorney can help.

At PALUMBO LAW, our experienced Rhode Island Property Insurance lawyers work strategically to help our clients to get what they deserve. We have deep experience working with insurance companies and understand how to deal with them. If you are planning on filing a fire damage claim, or if you have already filed your claim and been denied, we can help. To learn more or to schedule a free consultation, call us today!